Carbon Nanotubes 2023-2033: Market, Technology & Playersカーボンナノチューブ2023-2033年:市場、技術、プレーヤー この調査レポートは、主にエネルギー貯蔵におけるCNTの役割によって、2023-2033年のCNT市場の成長を予測しています。 主な掲載内容(目次より抜粋) CNT生産 CNT材... もっと見る

※ 調査会社の事情により、予告なしに価格が変更になる場合がございます。

Summary

この調査レポートは、主にエネルギー貯蔵におけるCNTの役割によって、2023-2033年のCNT市場の成長を予測しています。

主な掲載内容(目次より抜粋)

Report Summary

Carbon nanotube market growth driven by booming lithium-ion battery demand

After years of promise, we are witnessing the first major market adoption of nanocarbons. Although known for several decades, with a large amount of commercial engagement, and some extraordinary properties, CNTs have largely been kept to specific applications and relatively low market sales until now. IDTechEx forecast strong growth for the CNT market over the coming decade, driven primarily by the role of CNTs in energy storage.

This market report gives a comprehensive overview of the CNT industry including the manufacturers, material and process landscape, applications, and forecasts.

Carbon nanotubes (CNTs) have been known for many decades, but the moment of significant commercial growth is now upon us. Through expansions, partnerships, acquisitions, and greater market adoption there are clear indicators that true market success is being realized for the first time.

This report gives granular 10-year market forecasts, player analysis, technology benchmarking, and a deep-dive in core application areas. This detailed technical analysis is built on a long history in the field of nanocarbons and is based on primary-interviews with key and emerging players.

Technology

The potential for CNTs needs no introduction. If the exciting nanoscale properties, from mechanical to thermal & electrical conductivity and beyond, can be realized, then the global impact will be profound. However, as is well known, the reality is much further from the theoretical ideals.

There is a wide range of technology and manufacturing readiness for the different types of nanotubes. Making the nanotubes is just the first step; a large amount of consideration needs to go into understanding how they can be functionalized, purified and/or separated, and integrated. This report goes into extensive detail benchmarking the physical and economic properties of MWCNTs, FWCNTs, and SWCNTs; it extends to key advancements in this post-processing and dispersion technology, which is an essential part for any market success.

There is also the trend to making "macro-CNT" products most commonly in the form of sheets/veils or yarns. There are numerous technical challenges in translating the core beneficial properties from the nanoscale, but some promising results and emerging applications are being observed; within this, vertically aligned CNTs (VACNTs) are one of the most exciting areas taking advantage of the inherent anisotropy of the nanotubes.

It is also important to consider the incumbent and emerging competition. In most applications the CNTs are acting as an additive and competing against other conductive carbon materials from chopped carbon fiber to carbon black and graphene; the combination of properties is essential for adoption and looking beyond to non-tradition figures-of-merit can give indication of where the market potential lies.

Players

MWCNT production has been established for a long time with most employing a catalytic CVD process, but there remain technical and economic improvements to the MWCNT production and how they are post-processed. This report details the key manufacturers and those further up the supply chain; geographically East Asia has taken a dominant position and leads the way in both installed and planned capacity.

For MWCNTs there are 3 key news stories: the funding raised and planned expansion of Jiansgu Cnano Technology, the increasing LG Chem capacity, and the investment by Cabot Corporation (having previously acquired SUSN). Most of this movement is linked with the energy storage market and the role CNTs can play as conductive additives for either electrode in both current and next-generation lithium-ion batteries. However, they are not alone, there are other companies making great strides and with the inevitable consolidation the time for growth is now.

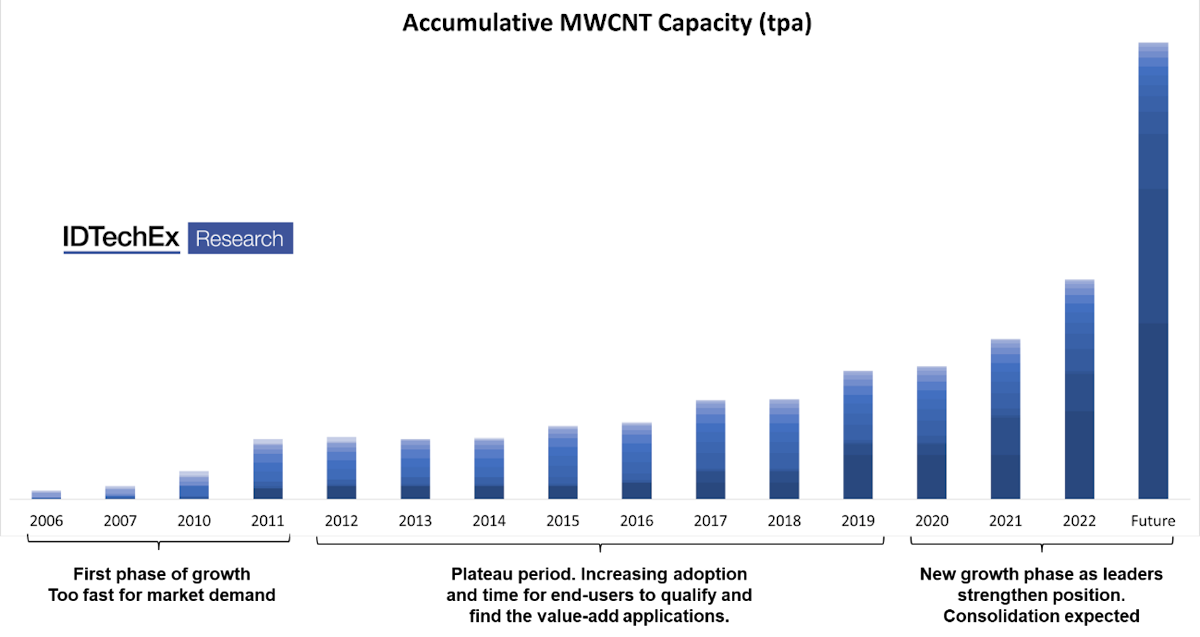

This is not the first-time this expansion has been planned, as seen in the figure below. In the build up to 2011, there were several expansions that ultimately proved premature; as a result some players left the field and a subsequent period of capacity stagnation was observed. However, during this period utilization grew and end-users continued to experiment and find application areas where there is genuine added value. Beyond 2020, we are entering into a new age of expansions, driven by the role in cathodes for lithium-ion battery within the booming electric vehicle market.

That is not to say this is a done deal, there is still a large amount of innovation and development from production to functionalization and integration. This could be in forming unique species with a very high-aspect ratio, forming hybrid products in conjunctions with other additives, using alternative feedstocks or forming highly conductive continuous yarns.

SWCNTs are at an earlier stage but there is still a high-level of commercial activity. There is more diversity in the manufacturing from using CO feedstocks to plasma processes and combustion synthesis. This report goes through each of these processes with key profiles and player analysis. With key partnerships being established, some expansion and crucially some market activity these materials are at their start of their commercial journey.

Markets

This report provides granular 10-year forecasts for MWCNTs and DWCNTs & SWCNTs segmented by end-use application.

MWCNTs have numerous application areas from thermal interface materials to coatings but the key sectors are as an additive in energy storage and polymers.

Energy storage: Driven by the demand for electrification, this market is booming and CNTs are well positioned. The nanotubes act as a conductive additive for either electrode in both current and next-generation lithium-ion battery designs, incorporation of a relatively small weight % can have a significant boost to energy density. The enhanced conductivity is obvious, but the mechanical properties are also very important in providing anchorage that enables thicker electrodes, wider temperature range, or materials that give a higher capacity. How they are dispersed, used with or without a binder, and combined with other additives are all examined in extensive detail within the report. Although lacking the same addressable market, there are also key developments in the role of CNTs for ultracapacitors that are explored in a dedicated chapter.

Polymer additives: Either in a standalone polymer matrix or within a fiber reinforced polymer composite, CNTs can play a significant role through their blend of properties. This can range from improving interlaminar strength in composite layups to improving the electrostatic discharge capabilities. There have been some longstanding success stories here including for fuel systems and electronic packaging, but with energy storage dramatically increasing the volume, and the price correspondingly dropping, more applications will open up over the next decade.

SWCNTs will compete with MWCNTs, particularly as additives for energy storage and elastomer applications, but given their unique properties they are also gaining traction in novel areas such as memory, sensors, and other electronic applications.

Carbon Nanotubes 2023-2033: Market, Technology, Players provides a definitive assessment of this market. IDTechEx has an extensive history in the field of nanocarbons and their technical analysts and interview-led approach brings the reader unbiased outlooks, benchmarking studies, and player assessments on this diverse and expanding industry.

Key aspects

An evaluation of players in the carbon nanotube market:

An analysis of carbon nanotube technologies:

A detailed account of the most critical application areas for carbon nanotubes:

Carbon nanotube market forecasts:

Table of Contents

|