Summary

About the Report:

This report updates CIR’s forecasts of the co-packaged optics modules market with breakouts by network segment application and data rate. It also provides an update on CPO strategy from the key influencers in the market. In terms of speed, we look at 800G and 1.6T. Another objective of our latest report includes efforts to better present the product roadmap for CPO in the near- to medium-term future. The report includes some analysis of important subsystems of CPO devices, notably the external lasers and the potential additional cooling for the CPO module. We also address the role of silicon photonics and the impact of optical integration on the future of CPO.

In terms of coverage, the report concerns itself with CPO and precursors to CPO, meaning near-packaged optics (NPO). In terms of applications, we cover all likely applications, but aside from organic traffic growth made up of voice, data and video traffic, the forecasts also reflect an expected boom for low-latency traffic and how the growth of AI (enterprise, SaaS and individual) is resetting the thinking. The market for CPO in HPC, disaggregated computing applications and sensors are also analyzed and forecasted. Finally, the report considers the market impact of the emerging standards for CPO including the just-released OIF standard and the work on standards setting beginning in China.

Report Highlights:

-

CIR sees data centers generating $19 plus billion revenues of aggregate spending on CPO over the 2023-2028 period. CIR believes that there will be significant deployment of CPO in the access network reaching $323 million in access deployments in 2027.

-

An inflection point in the evolution of optical integration is rapidly emerging that is bringing together CPO with chiplets and a new take on silicon photonics. This new type of optical integration does not yet have a name but differs from the approach that is based on novel materials.

-

Until recently CPO has seemed a way to protect US firms from Chinese competition in the transceiver module space. However, the Chinese have set up their own CPO development organization with widespread ambitions to place CPO deep in the network. At the same time a review of technical papers suggests that some of the more prominent Chinese transceiver companies have advanced plans to offer CPO products.

ページTOPに戻る

Table of Contents

※以下は旧版(2022年版)の目次です。最新版は別途お問合せ下さい。

Table of Contents

Executive Summary

E.1 Objective and Scope Of This Report

E.2 CPO Product Trends

E.3 The OIF Co-Packaging Framework

E.4 Near-Packaged Optics Emerges

E.5 Data Center Markets For CPO

E.5.1 CPO In the Hyperscale Data Center

E.5.2 Enterprise Data Centers

E.5.3 Telecom Data Centers

E.5.4 Edge Data Centers

Chapter One: Introduction: The Need for CPO in the Latency-sensitive Data Center

1.1 Background to This Report

1.1.1 Evolution of CPO in 2021 and Early 2022

1.1.2 CPO and the Changing Nature of Data Center Traffic

1.1.3 Five-year Forecast of CPO Products

1.2 Objective and Scope of This Report

Chapter Two: Recent Advances in CPO Products and Standards

2.1 Origins and Definitions of CPO Technology

2.1.1 CPO: Worthy Successors to Silicon Photonics and On-Board Optics

2.1.2 A Note on CPO and Chiplets

2.2 CPO Product Trends and Recent Developments

2.2.1 Ranovus

2.2.2 Marvell

2.2.3 Anritsu and SENKO

2.2.4 Ayar Labs and Lumentum

2.2.5 Furukawa Electric

2.2.6 Yet Other Firms

2.3 Standards and Agreements Related To CPO

2.4 The OIF Co-Packaging Framework

2.4.1 External Laser Small Form Factor Pluggable Project

2.4.2 Cooling Systems for Co-Packaging Co-packaged Engines

2.4.3 3.2T Co-Packaged Optics Optical Module

2.5 The Role of COBO

2.5.1 COBO CPO Working Group

2.6 Near-Packaged Optics

2.7 Impact of Next-Gen Pluggables

2.7.1 The Survivability of Pluggables

2.8 Switching Generations And CPO

2.9 Fitting CPO Into the Transceiver Supply Chain

2.9.1 Multiple Suppliers and Single Suppliers

2.10 CODA: Emerging Issues

2.11 Key Points from This Chapter

Chapter Three: Impact of Latency-Sensitive Traffic on Demand for CPO

3.1 New Types of Traffic

3.2 Videoconferencing and Online Events: Emerging Requirements

3.2.1 How Will the Video Boom Survive COVID-19?

3.3 Data Centers, AI and ML

3.3.1 Latency and AI

3.3.2 Networked AI and CPO

3.4 IOT AND IIOT

3.5 Other Kinds of Traffic

3.6 Key Points from This Chapter

Chapter Four: Rebuilding the Data Center with CPO: A Multi-year Projection

4.1 Forecasting Philosophy for CPO In the Data Center

4.1.1 An Optimistic Scenario for Co-packaged Optics

4.1.2 A Pessimistic Scenario for Co-packaged Optics

4.1.3 New Thoughts on Pricing

4.1.4 Growth of Data Centers

4.2 CPO In the Hyperscale Data Center

4.2.1 Forecasts of CPO in the Hyperscale Data Center

4.2.2 A Note on HPC in the Hyperscale Data Center

4.3. Enterprise Data Centers

4.3.1 Forecasts of CPO In the Enterprise Data Centers

4.4 TELECOM DATA CENTERS

4.4.1 Forecasts of CPO in Telecom Data Centers

4.5 Edge Data Centers

4.5.1 Forecasts of CPO In Edge Data Centers

4.6 Summary of Forecasts

4.7 A Note on Switches as the Main Driver for High Data Rate Transceivers

4.8 CPO May Need Generational Change in The Data Center For A Real Take Off

4.9 Key Points from This Chapter

About the Author

Acronyms and Abbreviations Used in This Report

List of Exhibits

Exhibit E-1: Market Forecasts for CPO Devices in the Data Center ($ Millions)

Exhibit 1-1: Factors Shaping the Market for CPO Products in the Data Center

Exhibit 2-1: Selected Firms Shaping the CPO Space

Exhibit 2-2: OIF Membership

Exhibit 2-3: OIF Co-Packaging Framework Project: Scope

Exhibit 2-4: ELSFP: Possible Project Range

Exhibit 2-5: Specs for the Co-Packaged Optics Optical Module

Exhibit 2-6: Likely Supply Chain Trends for High-end Data Network Interfaces in the CPO Era

Exhibit 3-1: Required Latencies by Selected Type of Traffic

Exhibit 3-2: Emerging forms of Traffic and Their Impact on CPO Demand

Exhibit 4-1: Potential Groups that Will Benefit from Co-packaged Optics in Data Centers

Exhibit 4-2: Market Forecasts for CPO Devices in the Hyperscale Data Center

Exhibit 4-3: Market Forecasts for CPO Devices in the Enterprise Data Center

Exhibit 4-4: Market Forecasts for CPO Devices in the Telecom Data Center

Exhibit 4-5: Market Forecasts for CPO Devices in the Edge Data Center

Exhibit 4-6: Summary of Market Forecasts for CPO Devices in Data Centers ($ Millions)

Press Release

April 20, 2023

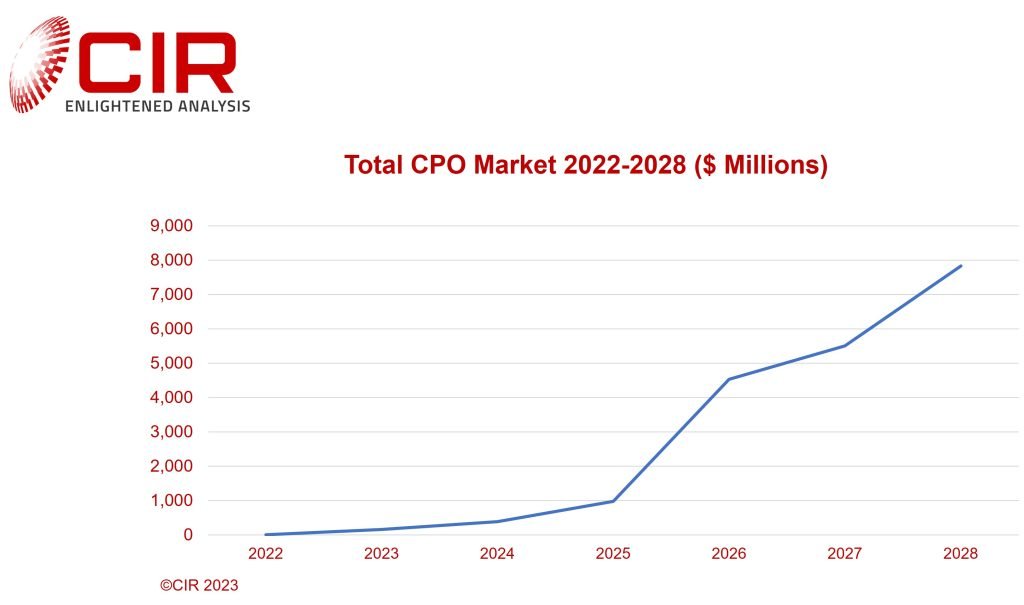

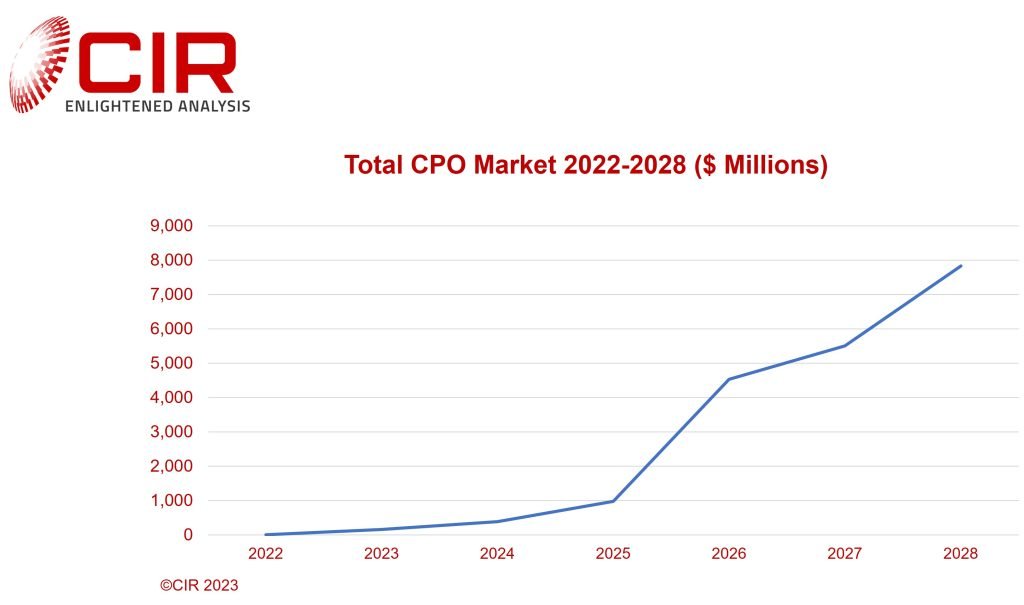

CIR Issues Latest Market Analysis and Forecast of Co-Packaged Optics Module Market, Sees $5.5 Billion Market in 2027

Crozet VA: Industry analyst firm, CIR, has issued its latest report on the co-packaged optics modules market. In the report the firm predicts that the co-packaged optics modules market will reach $5.5 billion in 2027, including NPO products. Driven by the new OIF Implementers Agreement (IA), co-packaged optics now has a much clearer adoption path within data centers. In addition, this new interface standard created specifically for the age of latency sensitive traffic such as that created by the current AI boom provides an additional, and crucial enabling factor.

“CIR sees tremendous potential for co-packaged optics that can begin to be realized in the next two years,” according to CIR’s President and the report’s author, Lawrence Gasman. “CPO provides a pathway to 1.6T and beyond.”

About the Report:

This report updates CIR’s forecasts of the co-packaged optics modules market with breakouts by network segment application and data rate. It also provides an update on CPO strategy from the key influencers in the market. In terms of speed, we look at 800G and 1.6T. Another objective of our latest report includes efforts to better present the product roadmap for CPO in the near- to medium-term future. The report includes some analysis of important subsystems of CPO devices, notably the external lasers and the potential additional cooling for the CPO module. We also address the role of silicon photonics and the impact of optical integration on the future of CPO.

In terms of coverage, the report concerns itself with CPO and precursors to CPO, meaning near-packaged optics (NPO). In terms of applications, we cover all likely applications, but aside from organic traffic growth made up of voice, data and video traffic, the forecasts also reflect an expected boom for low-latency traffic and how the growth of AI (enterprise, SaaS and individual) is resetting the thinking. The market for CPO in HPC, disaggregated computing applications and sensors are also analyzed and forecasted. Finally, the report considers the market impact of the emerging standards for CPO including the just-released OIF standard and the work on standards setting beginning in China.

Report Highlights:

CIR sees data centers generating $19 plus billion revenues of aggregate spending on CPO over the 2023-2028 period. CIR believes that there will be significant deployment of CPO in the access network reaching $323 million in access deployments in 2027.

An inflection point in the evolution of optical integration is rapidly emerging that is bringing together CPO with chiplets and a new take on silicon photonics. This new type of optical integration does not yet have a name but differs from the approach that is based on novel materials.

Until recently CPO has seemed a way to protect US firms from Chinese competition in the transceiver module space. However, the Chinese have set up their own CPO development organization with widespread ambitions to place CPO deep in the network. At the same time a review of technical papers suggests that some of the more prominent Chinese transceiver companies have advanced plans to offer CPO products.

About CIR:

CIR has published hype-free industry analysis for optical networking and photonics for more than 35 years. Our reports provide informed and reasoned market forecasts and industry analysis to a global roster of clients. In addition, to market analysis reports, CIR provides data sets of optical components with breakouts by types of data center and end user.

.jpg)