Summary

この調査レポートは世界の加入者データ管理(SDM)市場を調査し、ビジネスモデル、バリューチェーン分析、キャリアとベンダの戦略などを分析・解説しています。また2020年から2025年までの市場予測も行っています。

この調査レポートは世界の加入者データ管理(SDM)市場を調査し、ビジネスモデル、バリューチェーン分析、キャリアとベンダの戦略などを分析・解説しています。また2020年から2025年までの市場予測も行っています。

Overview

This report provides an assessment of the Subscriber Data Management (SDM) market, including business models, value chain analysis, carrier and vendor strategies, and a quantitative assessment of the industry from 2020 to 2025. The report includes analysis by service provider type (carriers and OTT service providers), network type (LTE and 5G), operational model (premise and cloud-based), and by geographic region of the world.

Subscriber data is a crucial commodity for network carriers worldwide, as it can be leveraged to provide customized services and optimize applications to the market based upon subscriber preferences. This creates opportunities for new and highly focused applications and services. Optimally leveraging subscriber data also facilitates revenue expansion as well as improved customer loyalty and profitability.

However, access to subscriber data is often a challenge for network operators. This is due largely to subscriber data being stored in a non-unified, distributed architecture that consists of a variety of different network elements and services. This legacy subscriber data architecture approach is often vendor-specific, which makes it costly to establish and maintain a consolidated view of the operational data.

Subscriber Data Management (SDM) systems provide solutions to these problems by unifying subscriber data into a central repository. With this repository, SDM solutions unify cross-domain subscriber data, including identity, location, presence, authentication, services and access preferences. These data elements may feed multiple applications through an API interface.

An important aspect of SDM is the 3GPP defined Unified Data Repository (UDR) function, which is central to storage and retrieval of data in 5G networks. UDR is also central to the 5G Service Based Architecture (SBA) approach, including application, subscription, authentication, service authorization, policy data, session binding and application state information.

Mind Commerce estimates indicate carriers can save up to 47 % in OpEx (associated with customer provisioning, administration, and application/service OSS/BSS) with next generation SDM as compared to legacy non-UDR mechanisms for managing subscriber data. In addition to OpEx savings, SDM solutions allow carriers to reduce churn rates by enabling carriers to personalize services, improve marketing campaigns, and improve overall revenue and customer retention by gaining rich customer insights.

Furthermore, SDM also allows carriers to establish themselves as brokers of subscriber identity through SDM APIs. Driven by internal utilization within carrier services and identity brokering, SDM APIs are anticipated to become a critical asset for 5G SBA based services realization and operation.

As network operators continue to invest in network modernization and migrate networks towards 5G, vendors from both telecommunications and IT centric database backgrounds are competing to gain SDM market share. As part of the 5G network build-out, global carriers are committed to continuing the migration toward a unified data environment that began with LTE networks. As a consequence, Mind Commerce expects SDM vendor revenues to reach $9.75B by 2025. North America is poised to benefit the most from this trend, becoming a $3.3B market by 2025.

Target Audience:

-

SDM vendors

-

Application developers

-

Data mining companies

-

ICT infrastructure vendors

-

Managed service providers

Select Report Findings:

-

Driven by 5G infrastructure investment, the Global SDM market will reach $9.75B by 2025

-

North America is poised to benefit the most from this trend, becoming a $3.3B market by 2025

-

Global cloud-based 5G Unified Data Management (UDM) will become a $370M market by 2025

-

Global 5G and LTE SDM will be $3.48B at 17.4% CAGR and $1.95B at 60.8% CAGR respectively by 2025

-

The global market for third-party SDM (OTT and managed services providers) infrastructure will exceed $1B by 2025

-

Centralized data management supported by cloud-based storage and retrieval will enable operational savings of up to 47%

ページTOPに戻る

Table of Contents

Table of Contents

1.0 Executive Summary

1.1 Topics Covered

1.2 Key Findings

1.3 Key Questions Answered

1.4 Target Audience

1.5 Companies

2.0 Subscriber Data Management Technology

2.1 Evolution Towards Next Generation SDM

2.1.1 What is SDM

2.1.2 Subscriber Data Management Network Elements

2.1.3 Legacy Subscriber Data Management Solutions

2.1.4 Converged Data in LTE and 5G Networks

2.1.5 Subscriber Data Management Standardization

2.2 Key Subscriber Data Management Solution Elements

2.2.1 SDM Enabling Technologies

2.2.2 Data Collection Engines

2.2.3 Identity Management Function

2.2.4 Subscriber Data Management Function

2.2.5 Subscriber Data Federation

2.3 Subscriber Data Management Deployment Scenarios

2.3.1 Centralized SDM Deployment Model

2.3.2 Federated or Virtualized SDM Deployment Model

2.3.3 Converged SDM Deployment Model

3.0 Subscriber Data Management Market Business Case

3.1 Subscriber Data Management Market Drivers

3.1.1 Capital Expenditure and Operational Expense Reduction

3.1.2 Subscriber Royalty and Churn Reduction

3.1.3 Elevating Customer Experience and Service Delivery

3.1.4 Service Personalization and Development of Unique Services

3.1.5 Providing a Foundation for Business Intelligence Applications

3.1.6 Identity Brokering: Competing with Web Providers

3.1.7 Network Densification and Heterogenous Networks

3.1.8 Private Wireless Networks

3.2 Subscriber Data Management Market Barriers

3.2.1 Privacy Constraints and Regulation

3.2.2 Investment Support

3.2.3 Integration Complexities

3.3 Subscriber Data Management Value Chain

3.4 Subscriber Data Management Industry Roadmap

3.4.1 Unification of ID Management Services

3.4.2 Commercialization of SDM APIs

3.4.3 Convergence with MDM

3.5 Subscriber Data Management Trends

3.5.1 Data Convergence: Users, Applications, and Policies

3.5.2 Open Architectures: Platforms and APIs

3.5.3 Intelligent Data Management and Information Services

4.0 Carrier SDM Deployment Case Studies

4.1 Bell Mobility Canada

4.2 Bharti Airtel

4.3 China Mobile

4.4 Cell C South Africa

4.5 Hutchison (H3G)

4.6 Movistar Argentina

4.7 Mobily Saudi Arabia

4.8 Orascom Telecom Algeria

4.9 Sprint

4.10 Safaricom Kenya

4.11 Telenor Pakistan

4.12 TIM Brasil

4.13 TeliaSonera

4.14 Tele2 Sweden

4.15 Verizon Wireless

5.0 Global SDM Market Analysis and Forecasts 2020 - 2025

5.1 Global Subscriber Data Management Market 2020 - 2025

5.2 Subscriber Data Management by Carriers and Third Parties 2020 - 2025

6.0 Carrier SDM Market Analysis and Forecasts 2020 - 2025

6.1 Premise-based vs. Cloud-based Carrier SDM 2020 - 2025

6.2 Carrier SDM Deployment by Options 2020 - 2025

6.3 Carrier SDM by Solutions 2020 - 2025

6.4 Premise based LTE SDM vs. 5G SDM 2020 - 2025

6.5 Cloud based LTE SDM vs. 5G SDM 2020 - 2025

6.6 5G UDM vs. 5G CUDM 2020 - 2025

6.7 5G Stateful UDM and Stateless UDM 2020 - 2025

6.8 Carrier SDM Market by Region 2020 - 2025

6.8.1 North America Carrier SDM Market by Country 2020 - 2025

6.8.2 South America Carrier SDM Market by Country 2020 - 2025

6.8.3 Europe Carrier SDM Market by Country 2020 - 2025

6.8.4 APAC Carrier SDM Market by Country 2020 - 2025

6.8.5 MEA Carrier SDM Market by Country 2020 - 2025

7.0 SDM Market by Third-Party Service Provider 2020 - 2025

7.1 Premise-based vs. Cloud-based Third Party SDM 2020 - 2025

7.2 Third Party SDM Deployment by Options 2020 - 2025

7.3 Third Party SDM by Solutions 2020 - 2025

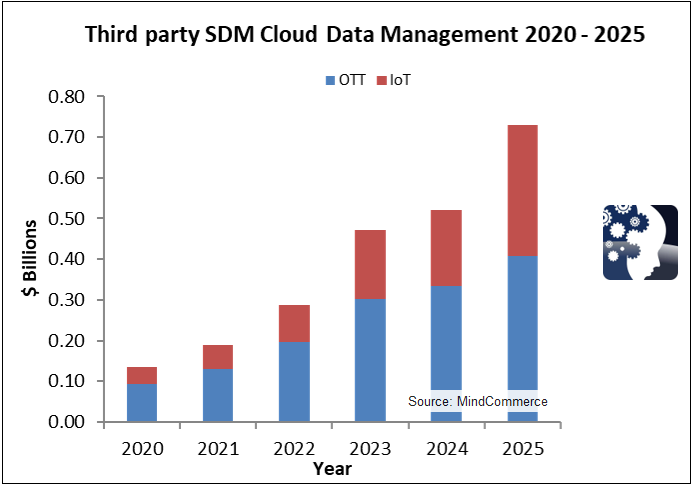

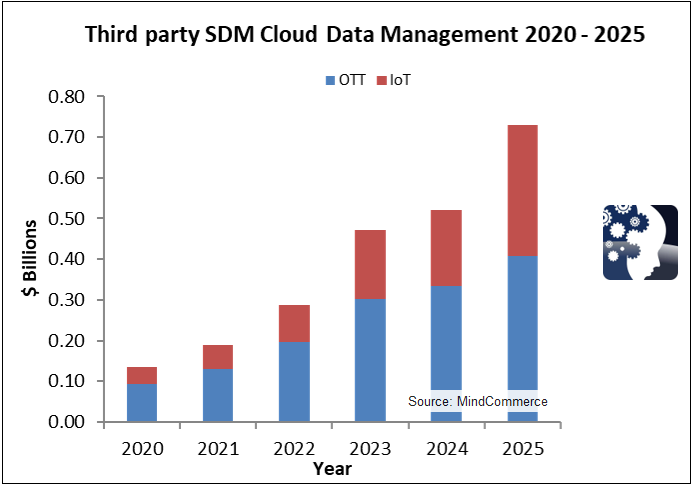

7.4 Third Party SDM by Cloud Data Management 2020 - 2025

7.5 Managed Service Provider SDM vs. OTT Service Provider Third Party SDM 2020 - 2025

7.6 Third Party SDM Market by Region 2020 - 2025

7.6.1 North America Third Party SDM Market by Country 2020 - 2025

7.6.2 South America Third Party SDM Market by Country 2020 - 2025

7.6.3 Europe Third Party SDM Market by Country 2020 - 2025

7.6.4 APAC Third Party SDM Market by Country 2020 - 2025

7.6.5 MEA Third Party SDM Market by Country 2020 - 2025

Figures

Figure 1: Data Migration to HSS

Figure 2: IoT Policy Management

Figure 3: The SDM Value Chain

Figure 4: The Telecom API Value Chain

Figure 5: Global SDM Market 2020 - 2025

Figure 6: Subscriber Data Management by Type 2020 - 2025

Figure 7: Premise-based vs. Cloud-based Carrier SDM 2020 - 2025

Figure 8: Carrier SDM Deployment by Options 2020 - 2025

Figure 9: Carrier SDM by Solutions 2020 - 2025

Figure 10: Premise based LTE SDM vs. 5G SDM 2020 - 2025

Figure 11: Cloud based LTE SDM vs. 5G SDM 2020 - 2025

Figure 12: 5G UDM vs. 5G CUDM 2020 - 2025

Figure 13: 5G Stateful UDM and Stateless UDM 2020 - 2025

Figure 14: Carrier SDM Market by Region 2020 - 2025

Figure 15: North America Carrier SDM by Country 2020 - 2025

Figure 16: South America Carrier SDM by Country 2020 - 2025

Figure 17: Europe Carrier SDM by Country 2020 - 2025

Figure 18: APAC Carrier SDM by Country 2020 - 2025

Figure 19: MEA Carrier SDM by Country 2020 - 2025

Figure 20: Premise-based vs. Cloud-based Third Party SDM 2020 - 2025

Figure 21: Third Party SDM Deployment by Options 2020 - 2025

Figure 22: Third Party SDM by Solutions 2020 - 2025

Figure 23: Third Party SDM by Cloud Data Management 2020 - 2025

Figure 24: Managed Services vs. OTT Service Provider SDM 2020 - 2025

Figure 25: Third Party SDM Market by Region 2020 - 2025

Figure 26: North America Third Party SDM by Country 2020 - 2025

Figure 27: South America Third Party SDM by Country 2020 - 2025

Figure 28: Europe Third Party SDM by Country 2020 - 2025

Figure 29: APAC Third Party SDM by Country 2020 - 2025

Figure 30: MEA Third Party SDM by Country 2020 - 2025

Tables

Table 1: Global SDM Market 2020 - 2025

Table 2: SDM by Type 2020 - 2025

Table 3: Premise-based vs. Cloud-based Carrier SDM 2020 - 2025

Table 4: Carrier SDM Deployment by Options 2020 - 2025

Table 5: Carrier SDM by Solutions 2020 - 2025

Table 6: Premise based LTE SDM vs. 5G SDM 2020 - 2025

Table 7: Cloud based LTE SDM vs. 5G SDM 2020 - 2025

Table 8: 5G UDM vs. 5G CUDM 2020 - 2025

Table 9: 5G Stateful UDM and Stateless UDM 2020 - 2025

Table 10: Carrier SDM Market by Region 2020 - 2025

Table 11: North America Carrier SDM by Country 2020 - 2025

Table 12: South America Carrier SDM by Country 2020 - 2025

Table 13: Europe Carrier SDM by Country 2020 - 2025

Table 14: APAC Carrier SDM by Country 2020 - 2025

Table 15: MEA Carrier SDM by Country 2020 - 2025

Table 16: Premise-based vs. Cloud-based Third Party SDM 2020 - 2025

Table 17: Third Party SDM Deployment by Options 2020 - 2025

Table 18: Third Party SDM by Solutions 2020 - 2025

Table 19: Third Party SDM by Cloud Data Management 2020 - 2025

Table 20: Managed Services vs. OTT Service Provider SDM 2020 - 2025

Table 21: Third Party SDM Market by Region 2020 - 2025

Table 22: North America Third Party SDM by Country 2020 - 2025

Table 23: South America Third Party SDM by Country 2020 - 2025

Table 24: Europe Third Party SDM by Country 2020 - 2025

Table 25: APAC Third Party SDM by Country 2020 - 2025

Table 26: MEA Third Party SDM by Country 2020 - 2025

この調査レポートは世界の加入者データ管理(SDM)市場を調査し、ビジネスモデル、バリューチェーン分析、キャリアとベンダの戦略などを分析・解説しています。また2020年から2025年までの市場予測も行っています。

この調査レポートは世界の加入者データ管理(SDM)市場を調査し、ビジネスモデル、バリューチェーン分析、キャリアとベンダの戦略などを分析・解説しています。また2020年から2025年までの市場予測も行っています。