(原文)

Telecommunication Briefing - Local Loop Revisited

Telecommunication Briefing - Local Loop Revisited

2005.1.25

The recent sale of non-infrastructure based service providers for low multiples of turnover raises questions again about the value of infrastructure ownership.

This briefing considers local loop privatisation alternatives in the context of the impact of loop ownership on economic efficiency. Trunk networks are not considered as the trunk market is highly competitive and costs and prices are low.

Telecommunication has been a critic in the past of the privatisation model that allows the former monopoly to keep all its ducts and cables. In Europe, there have even been cases of the incumbent assuming ownership of ducts which were the property of other government departments, reducing effectiveness of competitive services - especially to government itself.

But taking a balanced view of consumer benefit, service innovation, the need of government for short term gains in political capital, the desire by competitive investors for rapid introduction of competition, etc, Telecommunication now accepts that there was no practical alternative to permitting incumbents to keep the former monopoly's access infrastructure. However, Telecommunication also accepts that, as a result, national telecoms markets are destined to lower economic efficiency than other options may have delivered.

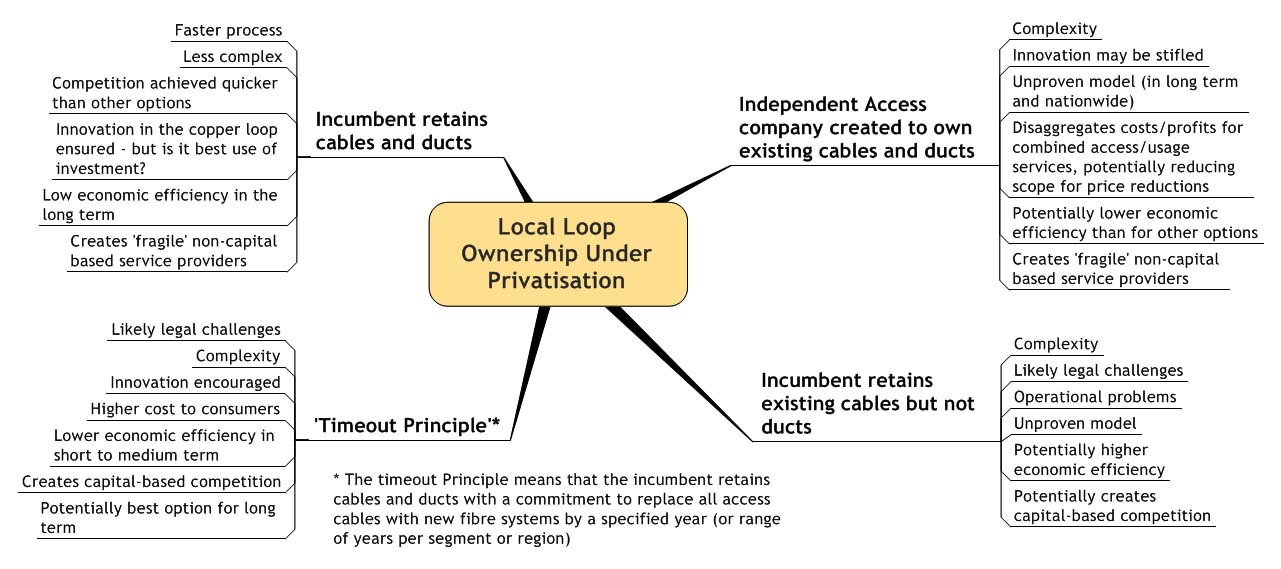

The key options and their relative benefits and pitfalls are shown in the chart below.

Source: Telecommunication Ltd, 2005 (クリックすると拡大表示)

Diseconomies

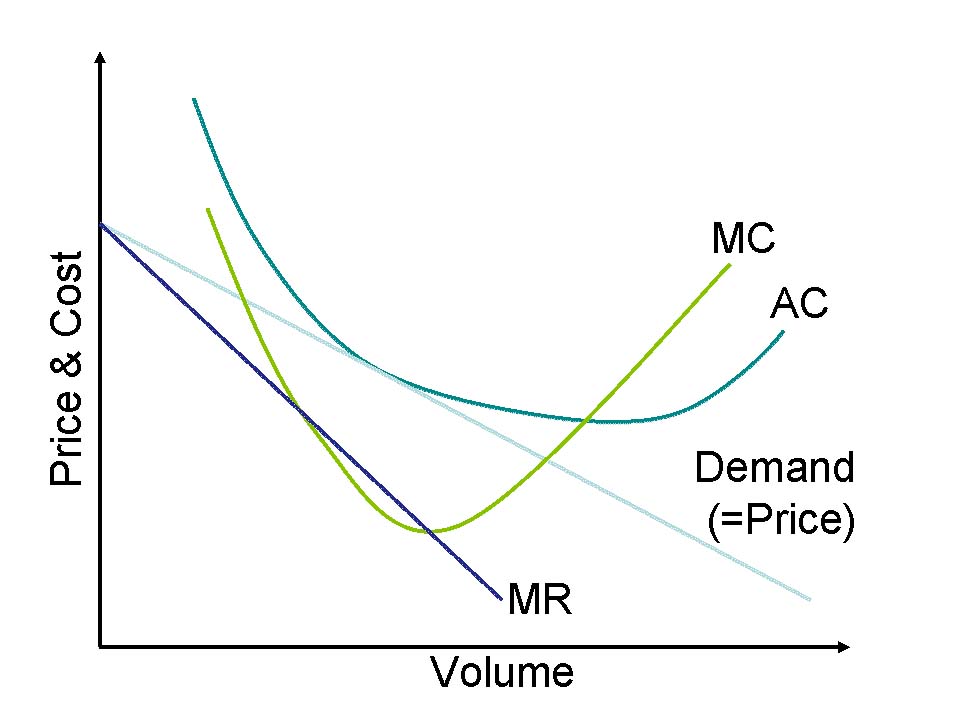

At the heart of this economic efficiency discussion is the classic economics concept of economies and diseconomies of scale. Essentially, enterprises which have not yet achieved critical mass are operating in one extreme diseconomy of scale. As 'production' increases, marginal costs reduce, and economies of scale are achieved. Optimal profitability is achieved when marginal cost and marginal revenue are equal to each other. When production is increased beyond this point, the law of diminishing returns applies and marginal costs increase again, creating the classic example of diseconomy of scale. Typical causes for this include disproportionate growth in overheads (for instance, HR functions) and diminishing leverage of capital assets.

At the heart of this economic efficiency discussion is the classic economics concept of economies and diseconomies of scale. Essentially, enterprises which have not yet achieved critical mass are operating in one extreme diseconomy of scale. As 'production' increases, marginal costs reduce, and economies of scale are achieved. Optimal profitability is achieved when marginal cost and marginal revenue are equal to each other. When production is increased beyond this point, the law of diminishing returns applies and marginal costs increase again, creating the classic example of diseconomy of scale. Typical causes for this include disproportionate growth in overheads (for instance, HR functions) and diminishing leverage of capital assets.

The top right chart shows the marginal cost trend line, where MC = Marginal Cost, AC = Average Cost and MR = Marginal Revenue.

Market Impact

How this impacts telecoms markets is that the incumbent, remaining large and retaining some characteristics of a state-owned monopoly, at least in the medium term, is subject to diseconomies of scale due to the law of diminishing returns.

This situation is worsened by regulator-imposed pricing for local loop unbundling (LLU), in order for the regulator to be seen to have achieved some degree of competition in the rapidly developing and nationally-crucial broadband market.

And this can be seen as a self-fulfilling prophecy; creating a poor economic environment for competitive investment in mass market infrastructure will result in the need for regulatory imposition on the near-monopoly in order to demonstrate that competition has been achieved, with all its consumer pricing implications.

Meanwhile, the absence of incentive for competitive operators to invest in local loop infrastructure, aided by LLU, locks them into diseconomies of scale through not having achieved critical mass and the need to rely on non-owned facilities. This almost guarantees valuations of a low turnover multiple, while incumbents expect to be valued at a multiple reflecting the potential value of their assets.

Wireless

Some may argue that the discussion above is made superfluous by radio developments. But consider the innovations achieved in copper technology since first hearing of the demise of the copper loop through the supremacy of fixed wireless.

Spectrum remains a limited resource irrespective of technical innovation, while major manufacturers continue to pursue technology that leverages the sunk costs of copper networks.

In the meantime, radio manufacturers do not seem to have achieved the price point required if radio is to be a true competitor to sunk-cost copper.

Furthermore, many radio standards exist while there are comparatively few variations of copper cable, providing low unit costs for copper solutions. And with radio, there is always the risk that spectrum licensing costs will be introduced by hungry governments even if that spectrum is freely available today.

And?

Expect to see telecoms service providers increasingly valued as any other-industry service provider, with the valuation based on the assumption that customers are not 'sticky'.

Also, expect to see only a small premium for trunk infrastructure, except where the enterprise being valued has capacity on routes where there is a known shortage. (But beware operators claiming leased capacity as their own.)

With low valuations compared to historic highs being applied to incumbents, even with their loop infrastructure, do not expect to see major competitive investment in mass market local infrastructure, unless there are special circumstances. A unique selling proposition or an exclusive local government arrangement may encourage competitive loop building, but USPs cannot be maintained in the long term and exclusive agreements may not withstand competition authority investigation.

通信業界レポート(Telecommunication Briefing) - ローカルループ再考

通信業界レポート(Telecommunication Briefing) - ローカルループ再考